Also in the news...

France: providing services and travelling for business

Guidance for UK businesses on rules for selling services to France.

Living in the USA

Information about moving to, living or retiring in the USA – including visas, working, healthcare and driving.

Trade with Liechtenstein

How you import from and export to Liechtenstein

UK trade with the United States: Impact of tariffs on imports and exports of goods

A closer look at the goods the UK trades with the United States in the context of trade tariffs.

Simplified rates for bringing personal goods into the UK

Find out about the simplified rates of customs and excise duty used when you declare your personal goods online.

The impact of industrial nations on global tax evasion

Are we doing something wrong in this world when it comes to fighting tax evasion? Obviously, yes!

While OECD, G20 and EU are not getting tired of stretching out their fingers on offshore countries, some of their own countries do have the largest impact on global tax evasion themselves. Therefore; if we want to fight tax evasion and tax injustice effectively, those who shout loudest should look into a mirror and start correcting themselves.

Legal loopholes, inefficient due diligence, financial secrecy and poor reporting are just some of the reasons that make the life of tax evaders more comfortable. The EU recently published a list of non-cooperative jurisdictions for tax purposes, consisting of the following countries in alphabetical order:

- American Samoa

- Bahrein

- Guam

- Marshall Islands

- Namibia

- Palau

- St. Lucia

- Samoa

- Trinidad & Tobago

It is not quite clear which objective criteria led to the inclusion of these countries in this list.

Impact is more important than the cause only

Countries like the Marshall Islands, Trinidad & Tobago, or Belize, the Bahamas and the Cayman Islands are among the known classical countries that provided and provide legislation that makes tax evasion quite easy. Thus, those countries, among others, were and are always the main target of OECD, G20 and EU member countries in their efforts to fight tax evasion and to establish tax justice.

However, do those (offshore) countries really have a substantial impact on global tax evasion and tax injustice?

The Tax Justice Network, an independent international network launched in 2003 and dedicated to high-level research, analysis and advocacy in the area of international tax and the international aspects of financial regulation, takes a different approach.

In its researches and analyses, the Tax Justice Network focuses not only on (harmful) financial secrecy, but on its impact on the global economy and on global tax losses as well.

Recently published research and analysis results of the Tax Justice Network are teaching us that we should review our efforts to stop tax evasion thoroughly and that we have to redefine our geographical targets and goals to fight tax evasion efficiently.

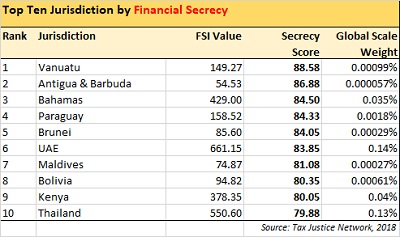

One of the important factors that make tax evasion easy is financial secrecy. The Tax Justice Network analysed 112 jurisdictions and calculated the Secrecy Scores of those jurisdictions. The highest (theoretical) score is 100, which would mean absolute financial secrecy. As per the analyses of the Tax Justice Network, the following countries are the global top ten in financial secrecy:

However, the sum of Global Scale Weight of these ten countries together is merely 0,35%. The Global Scale Weight defines how big a financial centre (country) is, in terms of financial services provided to non-residents. Thus, the many tax haven lists mean little in global terms, as these lists focus on focus on secrecy or on tax rates. Even if OECD, G20 and the EU would achieve full transparency of the countries listed on tax haven lists, the global impact on effective tax evasion would be negligible. We could not say that world really became more transparent.

The Financial Secrecy Index – naming the real sources of global tax evasion:

USA, Switzerland, Luxembourg, Germany, Hong Kong and others

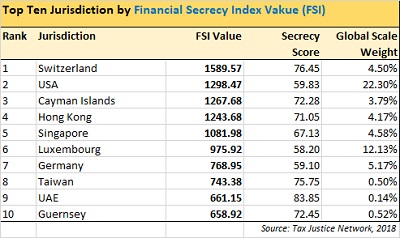

In addition to its analyses of financial secrecy, expressed by the Secrecy Score, the Tax Justice Network calculated the so-called Financial Secrecy Score (FSI), which considers both financial secrecy (= Secrecy Score) and the Global Scale Weight of each jurisdiction. Rather than only providing information about financial secrecy or tax rate ranking, the Financial Secrecy Score (FSI) ranks countries by the global scope of damage through tax evasion. The Top Ten countries by rank of global damage (=FSI) provides a totally different picture:

As the above table shows, a number of countries that shout loudest when it comes to fight tax evasion actually have the largest impact on global tax evasion: the USA, Luxembourg, Germany; and we should name the United Kingdom and France as well, because they are on rank 23 and 25 if the global FSI ranking.

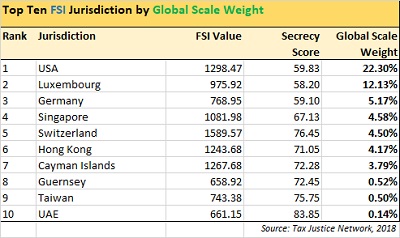

If we sort the countries by the Global Scale of Weight, in terms of financial services provided to non-residents, the picture becomes even more dramatical:

An interactive (sortable) table of all 112 jurisdictions can be seen on the website of the Tax Justice Network.

Conclusion

Tax evasion is not a trivial offence and must be addressed effectively. Effective efforts to fight tax evasion are those efforts that lead to effective results. Targeting only offshore countries does not lead to effective results. Targeting only countries with relative low taxes (i.e. Bulgaria, Romania, Malta, Cyprus) or countries with territorial taxation systems (i.e. Hong Kong, Singapore) does also not lead to effective results.

Measures of OECD, G20 and the EU must target countries with large global impact on damage through tax evasion.

But that will hardly happen, as the bosses of OECD, G20 and the EU will not really target themselves.

Shanda Consult provides sound and resilient advisory services regarding the right choice of jurisdiction for the place of business, considering factors of ecosystems, market aspects, various tax advantages, among others.