Also in the news...

Prove your English language abilities with a secure English language test (SELT)

For visa or citizenship applications, you may need to prove your knowledge of English by passing a secure English language test (SELT).

UK and Nigeria Enhanced Trade and Investment Partnership arrangement

The Enhanced Trade and Investment Partnership (ETIP) sets out the UK and Nigeriaís priorities for future discussion and cooperation.

Export to the UK: guidance for African businesses

Find out about UK markets and sectors, trade agreements, UK import regulations and taxes, and support for African businesses from the UK government.

Guidance Start exporting to Africa

Find out about market opportunities, trade partnership agreements, support from the UK government, and export regulations and taxes in African countries.

Guidance Start investing in African businesses

Find out about investment opportunities and support from the UK government. Learn how to manage risk, invest ethically, and access guidance on African countries.

Iranís Risk Rating has upgraded to 5

Iran's rating in the country risk classifications of the Participants to the Arrangement on Officially Supported Export Credits (CRE), has upgraded from 6 to 5 by the Organization for Economic Cooperation and Development (OECD).

After the last upgrade in Iranís rating in the country risk on June 2016, from 7 to 6, the OECD announced following its last meeting on Friday that Iranís risk rating has moved from 6 to 5.

According to OECD, the country risk classifications are meant toreflect country transfer and convertibility risk (Under the Participantsí system, country risk encompasses transfer and convertibility risk (i.e. the risk a government imposes capital or exchange controls that prevent an entity from converting local currency into foreign currency and/or transferring funds to creditors located outside the country).

Arash Shahraini, deputy head of Export Guarantee Fund of Iran, said during a telephone interview that ďThe upgrade was indeed a positive signal from the Europeans and a further indication of their interest to continue engaging with Iran within the framework of the nuclear deal,Ē

After the JCPOA (Nuclear Deal) between Iran and the P5+1 in 2015 and partial relief from International sanctions, Iran was expected the upgrade in risk rating in order to reduce the cost of attracting foreign finance and consequently increase the foreign exchange reserves.

This improvement is an important measure from OECD especially when US President, Donald Trump, tries to persuade Europeans to agree on imposing new sanctions against Iran.

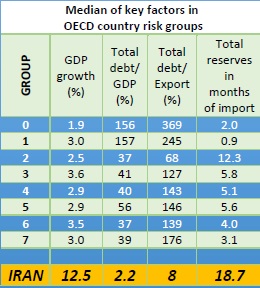

According to the International Monetary Fundís report in February 2017, Iranís official reserves were projected at $123.5 billion in 2016 -17 and the total debt to GDP of the country stood at 2.2%, which was lowest in the world. Also, the global lender reported 12.5% economic growth in Iran as the highest in the world.

Iranís economic indicators compared with the average performance of countries in each risk classification, showing that in 2016, Iran has outperformed other countries, according to the EGFIís report. ďThere are other factors that have a bearing on the OECDís final assessment including political risks and a countryís history in settling its external debtsĒ, a senior EGFI officer said.

During the sanctions era, Iran wasnít able to settle its external debts due to the restrictions in its financial relations with other countries. However, after the JCPOA and partial elimination of sanctions, the Central Bank of Iran (CBI) repaid the countryís debts and signed several restructuring agreements within a year.

Some of the signed agreements between Iran and other countries after the nuclear deal, are as follows:

Two agreements with China Development Bank and CITICTrust which worth $25 billion, an agreement worth €5 billion with Italyís Invitalia Global Investment, A contract with Austriaís Oberbank worth €1 billion, €500 million deal with Denmark's Danske Bank and two agreements worth €13 billion with South Koreaís Exim Bank and K-Sure.

Iran and Non-OECD countries

The upgrade in Iranís risk classification will improve business relations between Iran and financial institutions in the OECD-member countries and will boost their intention to expand collaboration with Iran, what their non-OECD competitors are already doing.

Iran has exported $7.73 billion worth of non-oil goods to BRICS member countries (Brazil, Russia, India, China and South Africa) during eight months in 2017 which shows 7.71% growth and comprises one-third of Iranís non-oil trade during this period. Since the nuclear deal was implemented, the BRICS countries have increasingly upgraded Iranís rating in their risk classifications.

Source: Financial Tribune

Shanda Consult is specialised in consultancy regarding project-based investments and as a partner in bringing together investors and investment projects.

For any consultation regarding your Iran-related business needs, please contact us.

Article supplied bt Shanda Consult